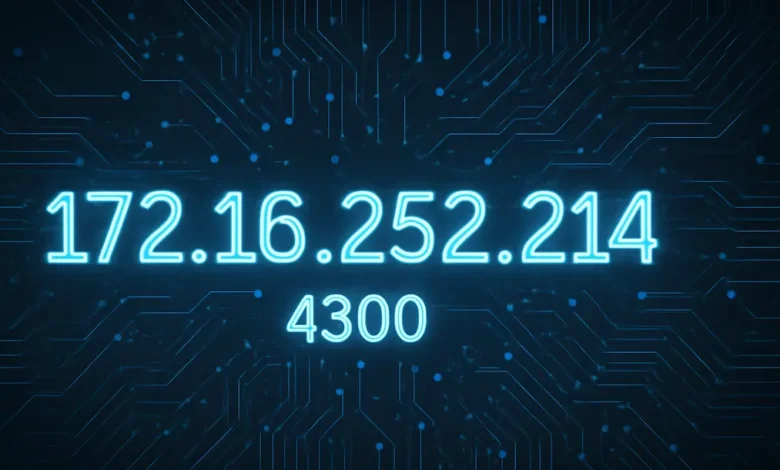

When examining the financial trading system configuration 172.16.252.2 14:4300, quantitative analysts and trading technology professionals encounter a critical financial infrastructure setup that typically involves algorithmic trading platforms, market data servers, or electronic trading systems operating on specialized port configurations. This financial network configuration represents essential capital markets infrastructure that requires ultra-low latency, high reliability, and stringent security measures. Understanding 172.16.252.2 14:4300 requires exploring financial trading protocols, market data management, and the demanding requirements of modern electronic trading environments.

Electronic Trading Platform Architecture and Order Management

The IP address 172.16.252.2 within financial trading environments typically designates core trading servers, order management systems, or market data distribution platforms that execute trades and manage financial transactions in real-time. This private IP addressing scheme provides network isolation while enabling high-frequency trading operations and supporting regulatory compliance requirements. The trading system design ensures transaction integrity while maintaining microsecond-level latency and supporting institutional trading volumes.

Port 4300 in trading environments often corresponds to proprietary trading protocols, custom market data feeds, or specialized financial applications that require dedicated communication channels for optimal execution speed and data reliability. This port configuration supports trading-specific communication requirements while enabling direct market access and supporting various financial market protocols. The communication architecture ensures rapid trade execution while supporting scalability and regulatory compliance.

High-Frequency Trading and Algorithmic Execution Systems

High-frequency trading (HFT) server configuration utilizing 172.16.252.2 14:4300 enables microsecond-level trade execution, algorithmic strategy deployment, and market making operations through ultra-low latency hardware and optimized software architectures. These trading platforms provide competitive execution speeds while supporting complex trading strategies and maintaining risk management controls. The HFT implementation ensures execution performance while maintaining regulatory compliance and risk oversight.

Algorithmic trading engines and strategy execution systems operating on port 4300 provide automated trading logic, portfolio management, and risk controls that execute trading strategies while monitoring market conditions and maintaining position limits. These algorithmic systems enable sophisticated trading while supporting risk management and operational oversight. The algorithmic trading ensures strategy execution while maintaining risk controls and performance monitoring.

Market Data Processing and Real-Time Analytics

Real-time market data processing systems through 172.16.252.2 14:4300 handle high-volume tick data, price feeds, and market information while providing latency-optimized data distribution and supporting trading decision-making requirements. This data infrastructure ensures information accuracy while supporting time-sensitive trading operations and market analysis. The market data processing ensures data integrity while maintaining ultra-low latency and supporting trading algorithms.

Financial analytics and quantitative modeling platforms connected via port 4300 provide statistical analysis, risk modeling, and performance measurement capabilities while supporting portfolio optimization and trading strategy development. These analytics systems enable data-driven trading while supporting quantitative research and strategy validation. The analytics implementation ensures trading intelligence while supporting research capabilities and performance analysis.

Risk Management and Compliance Systems

Integrated risk management systems utilizing 172.16.252.2 14:4300 provide real-time position monitoring, exposure calculation, and risk limit enforcement that protect against excessive losses while ensuring regulatory compliance and supporting prudent trading practices. These risk systems ensure trading safety while supporting operational oversight and regulatory requirements. The risk management ensures trading protection while maintaining compliance standards and operational integrity.

Regulatory reporting and compliance monitoring systems operating on port 4300 provide transaction reporting, audit trails, and regulatory submission capabilities while supporting MiFID II, Dodd-Frank, and other financial regulations. These compliance systems ensure regulatory adherence while supporting audit requirements and operational transparency. The compliance implementation ensures regulatory compliance while supporting operational accountability and audit readiness.

Trade Settlement and Post-Trade Processing

Trade settlement and clearing systems integrated with 172.16.252.2 14:4300 provide transaction confirmation, settlement processing, and clearing house connectivity while supporting straight-through processing and reducing operational risk. This settlement infrastructure ensures trade completion while supporting operational efficiency and counterparty risk management. The settlement processing ensures transaction finality while maintaining operational reliability and regulatory compliance.

Post-trade analytics and transaction cost analysis systems connected through port 4300 provide execution quality measurement, benchmark comparison, and trading performance analysis while supporting best execution requirements and operational optimization. These analytics systems ensure execution quality while supporting regulatory compliance and operational improvement. The post-trade analysis ensures execution oversight while supporting performance optimization and regulatory adherence.

Market Connectivity and Exchange Integration

Direct market access (DMA) and exchange connectivity through 172.16.252.2 14:4300 provide direct trading venue access, co-location benefits, and optimized routing while supporting multiple exchanges and alternative trading systems. This connectivity ensures market access while supporting execution quality and competitive trading operations. The market connectivity ensures trading access while maintaining execution performance and operational reliability.

Fix protocol implementation and message handling systems operating on port 4300 provide standardized trading communication, order routing, and execution reporting while supporting interoperability with trading venues and counterparties. These protocol systems ensure communication standards while supporting trading operations and regulatory reporting. The FIX implementation ensures trading communication while maintaining industry standards and operational compatibility.

Portfolio Management and Investment Operations

Portfolio management systems utilizing 172.16.252.2 14:4300 provide position tracking, performance attribution, and investment reporting capabilities while supporting institutional asset management and investment advisory operations. These portfolio systems ensure investment oversight while supporting client reporting and regulatory requirements. The portfolio management ensures investment tracking while maintaining performance measurement and client service standards.

Order management systems (OMS) and execution management systems (EMS) connected via port 4300 provide trade workflow management, execution algorithms, and order routing capabilities while supporting institutional trading operations and investment management. These management systems ensure trading efficiency while supporting institutional requirements and operational scalability. The order management ensures trading workflow while maintaining execution quality and operational control.

Quantitative Research and Strategy Development

Quantitative research platforms integrated with 172.16.252.2 14:4300 provide backtesting capabilities, strategy simulation, and model validation tools while supporting systematic trading strategy development and research activities. These research systems enable strategy innovation while supporting systematic trading and quantitative analysis. The research implementation ensures strategy development while maintaining analytical rigor and validation standards.

Alternative data integration and processing systems operating on port 4300 provide sentiment analysis, satellite imagery, and unconventional data sources while supporting alpha generation and trading edge development. These data systems enable innovative trading while supporting competitive advantage and strategy differentiation. The alternative data ensures trading innovation while maintaining data quality and analytical value.

Technology Infrastructure and Performance Optimization

Ultra-low latency network optimization for 172.16.252.2 14:4300 includes kernel bypass networking, FPGA acceleration, and hardware timestamping that minimize execution latency while supporting high-frequency trading requirements and competitive execution speeds. This optimization ensures trading performance while supporting technological competitive advantage and execution quality. The latency optimization ensures execution speed while maintaining system reliability and operational stability.

Co-location and proximity hosting services connected through port 4300 provide physical proximity to exchanges, reduced network latency, and optimized trading infrastructure while supporting competitive execution and market access. These hosting services ensure trading advantage while supporting operational efficiency and execution performance. The co-location ensures competitive positioning while maintaining operational reliability and performance optimization.

Cybersecurity and Operational Resilience

Financial cybersecurity frameworks for 172.16.252.2 14:4300 implement multi-layered security controls, threat detection, and incident response capabilities while protecting against cyber threats and maintaining trading system integrity. These security measures ensure system protection while supporting operational continuity and regulatory compliance. The cybersecurity framework ensures trading security while maintaining operational resilience and threat protection.

Business continuity and disaster recovery systems operating on port 4300 provide backup trading capabilities, data replication, and emergency operations while ensuring continuous trading operations and protecting against system failures. These continuity systems ensure operational resilience while supporting regulatory requirements and business protection. The disaster recovery ensures operational continuity while maintaining trading capabilities and data protection.

Regulatory Technology and Compliance Automation

RegTech solutions and compliance automation systems utilizing 172.16.252.2 14:4300 provide automated regulatory reporting, transaction monitoring, and compliance checking while reducing manual compliance tasks and ensuring regulatory adherence. These regulatory systems ensure compliance efficiency while supporting operational scalability and regulatory accuracy. The RegTech implementation ensures compliance automation while maintaining regulatory standards and operational efficiency.

Anti-money laundering (AML) and know-your-customer (KYC) systems connected via port 4300 provide customer due diligence, transaction monitoring, and suspicious activity reporting while supporting regulatory compliance and operational oversight. These compliance systems ensure regulatory protection while supporting operational integrity and risk management. The AML/KYC systems ensure regulatory compliance while maintaining operational oversight and risk protection.

Performance Monitoring and System Analytics

Trading system performance monitoring for 172.16.252.2 14:4300 includes latency measurement, throughput analysis, and system health monitoring while providing real-time alerting and performance optimization insights. These monitoring systems ensure operational awareness while supporting performance optimization and issue prevention. The performance monitoring ensures system reliability while maintaining execution quality and operational excellence.

Financial system analytics and reporting platforms operating on port 4300 provide trading analytics, risk reporting, and performance dashboards while supporting management oversight and regulatory reporting requirements. These analytics systems ensure operational intelligence while supporting strategic decision making and regulatory compliance. The system analytics ensure operational insights while maintaining management visibility and performance tracking.

Conclusion

The financial trading system configuration 172.16.252.2 14:4300 represents a sophisticated electronic trading infrastructure that requires specialized expertise in financial technology, trading systems architecture, and market microstructure to ensure reliable, ultra-low latency trading operations that support competitive execution and regulatory compliance in modern capital markets. This configuration enables diverse trading applications from high-frequency trading and algorithmic execution to institutional portfolio management and market making while maintaining the highest standards for execution performance, risk management, and regulatory adherence. Whether supporting proprietary trading, institutional asset management, market making, or quantitative research, proper configuration and management of 172.16.252.2 14:4300 ensures trading system reliability while maintaining performance standards and supporting organizational objectives through effective trading technology administration and financial system management across diverse capital markets environments and trading requirements.